Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

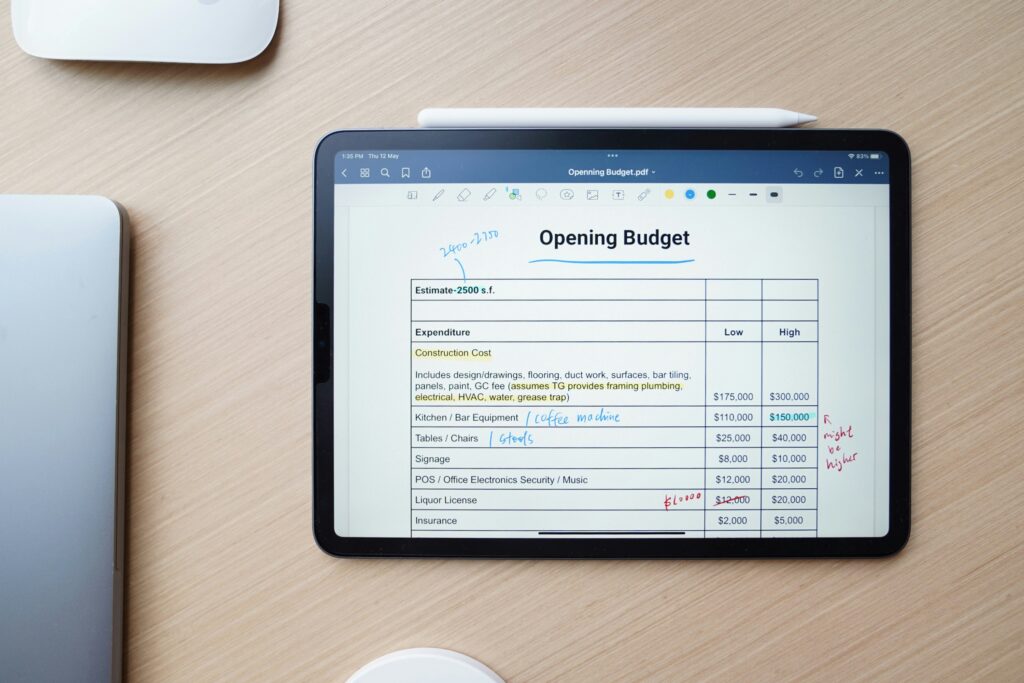

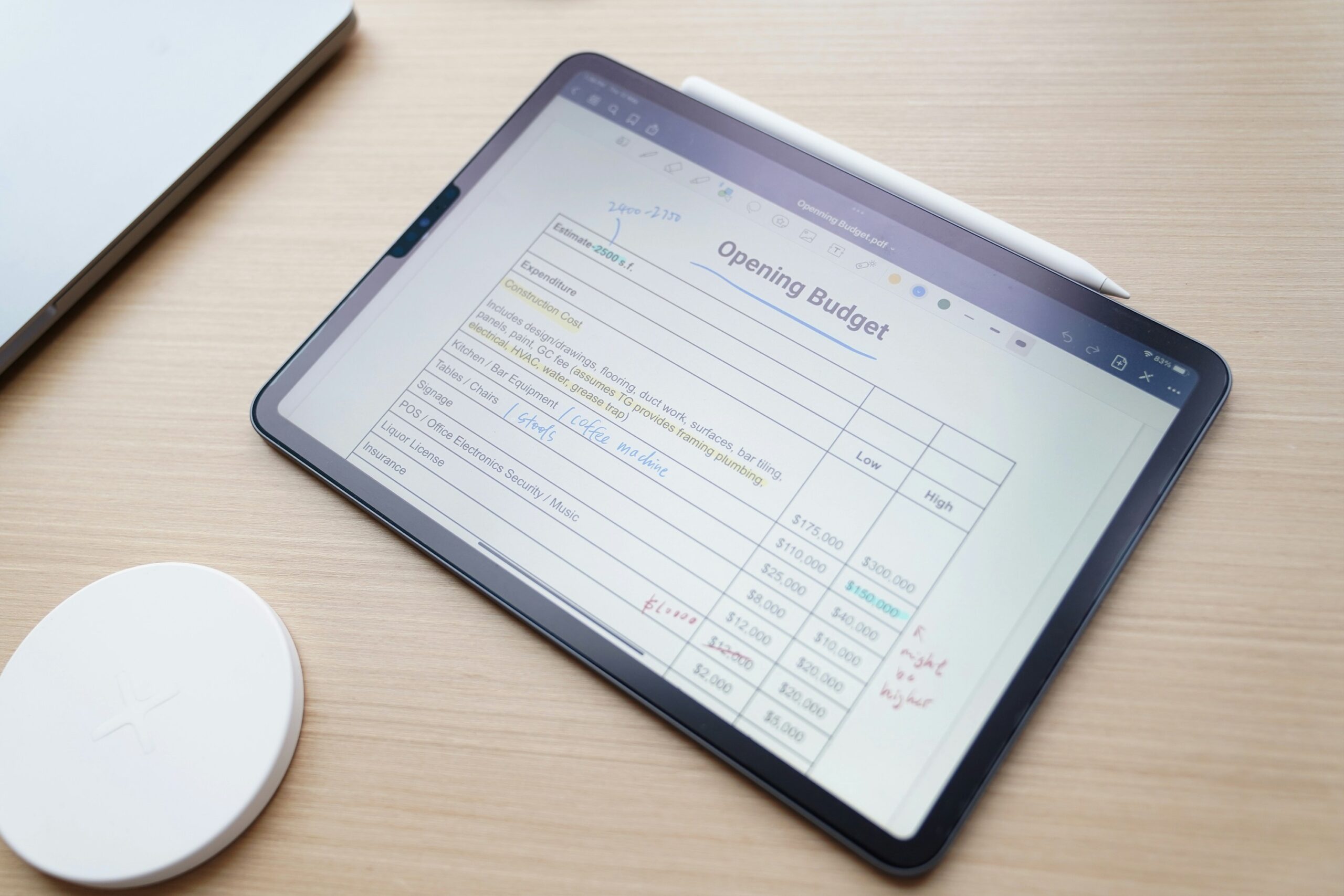

Budgeting is one of the most essential tools for achieving financial stability and reaching your financial goals. Whether you’re saving for a big purchase, paying off debt, or simply trying to make the most of your income, a well-crafted budget can be your roadmap to financial success. In this article, we’ll explore the fundamentals of budgeting, why it’s crucial, and how to create and stick to a budget that works for you.

Budgeting Intoduction

Why Budgeting Matters

Budgeting is more than just tracking expenses; it’s about taking control of your financial future. A budget helps you:

Understand Your Spending: By tracking where your money goes, you can identify wasteful spending and allocate funds to more important areas.

Set and Achieve Financial Goals: Whether it’s saving for retirement, buying a home, or building an emergency fund, a budget allows you to set clear goals and work towards them.

Avoid Debt: With a budget, you’re less likely to overspend and more likely to live within your means, reducing the need for credit and loans.

Peace of Mind: Knowing that you have a plan for your finances can reduce stress and help you feel more secure.

1. Determine Your Income

Start by calculating your total monthly income. This includes your salary, any freelance work, investment returns, and any other sources of income. Knowing exactly how much money you have coming in each month is the foundation of your budget.

2. List Your Expenses

Next, list all your monthly expenses. These can be divided into fixed and variable expenses:

Fixed Expenses: These are expenses that remain the same each month, such as rent, mortgage payments, car payments, and insurance.

Variable Expenses: These fluctuate each month, like groceries, utilities, entertainment, and dining out.

3. Categorize and Prioritize

Once you’ve listed your expenses, categorize them into needs and wants. Needs are essentials like housing, food, and utilities. Wants are non-essential expenses like dining out, subscriptions, and entertainment. Prioritize your needs first when allocating your budget.

4. Set Financial Goals

What do you want to achieve with your money? Setting financial goals is crucial in guiding your budgeting decisions. Goals can be short-term (saving for a vacation), medium-term (paying off debt), or long-term (retirement planning). Make sure your goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

5. Allocate Your Income

With your expenses categorized and your goals set, it’s time to allocate your income. Start by covering your needs, then allocate funds towards your financial goals. Finally, allocate money for your wants. If you find that your expenses exceed your income, look for areas to cut back.

6. Track Your Spending

Tracking your spending is key to sticking to your budget. You can do this manually, use a spreadsheet, or rely on budgeting apps like Mint, YNAB, or PocketGuard. Regularly reviewing your spending helps you stay on track and make adjustments as needed.

7. Adjust and Rebalance

Life is unpredictable, and your budget should be flexible enough to adapt. If you get a raise, lose income, or face an unexpected expense, revisit your budget and make necessary adjustments. Regularly reviewing and rebalancing your budget ensures that it remains aligned with your financial situation and goals.

Discere veritus detraxit pri ut, sea ei dicunt theophrastus. Eum harum animal debitis cu, viderer vituperatoribus mei ea. Id sed illud facete singulis, reque dolore mediocrem vim ei. Has epicuri accusamus intellegebat ad, no qui dicat laoreet scribentur, cum natum salutatus cu. Ne quem suas recusabo nam. Cum at dicunt oblique. Discere veritus detraxit pri ut, sea ei dicunt theophrastus. Eum harum animal debitis cu, viderer vituperatoribus mei ea. Id sed illud facete singulis, reque dolore mediocrem vim ei.

There are several budgeting methods to choose from, each with its own approach to managing money. Here are a few popular ones:

1. The 50/30/20 Rule

This simple rule divides your after-tax income into three categories:

The 50/30/20 rule is ideal for those who prefer a straightforward approach to budgeting.

2. Zero-Based Budgeting

With zero-based budgeting, every dollar you earn is allocated to a specific category or goal until your income minus expenses equals zero. This method requires careful planning and tracking but ensures that every dollar has a purpose.

3. Envelope System

Popularized by financial expert Dave Ramsey, the envelope system involves dividing cash into envelopes for different spending categories. Once the money in an envelope is gone, you can’t spend any more in that category for the month. This method is particularly effective for those who struggle with overspending.

4. Pay Yourself First

This method prioritizes savings by treating it as a fixed expense. You set aside a portion of your income for savings before paying any other bills or expenses. The remaining money is then used for your needs and wants.

1. Inconsistent Income

For those with irregular income, budgeting can be challenging. The key is to base your budget on your lowest monthly income and build an emergency fund to cover months when your income is lower than expected.

2. Unexpected Expenses

Unexpected expenses can derail your budget if you’re not prepared. Building an emergency fund is crucial for handling these expenses without going into debt.

3. Sticking to the Budget

Many people struggle with sticking to their budget. To overcome this, review your budget regularly, adjust it as needed, and stay focused on your financial goals. Using cash for discretionary spending can also help limit overspending.

Budgeting is a powerful tool for taking control of your finances and achieving your financial goals. By understanding your income and expenses, setting clear goals, and choosing a budgeting method that works for you, you can create a budget that helps you live within your means and build a secure financial future. Remember, the key to successful budgeting is consistency and regular review, so make budgeting a habit, and you’ll be well on your way to financial success.